Population Demographics for Retail Industry Fashion

Does your trade area population include more homeowners or renters? Baby Boomers, Gen-Xers, or Millenials? Which indigenous groups are represented in the population? If they are dwelling owners, how likely are they to buy dwelling effects, renovate their homes, or spend leisure-fourth dimension landscaping their yards?

To analyze market opportunities for your downtown, you need to examine data and enquire questions like the above almost residents of your merchandise surface area(south). This data must include the absolute number of residents, as well as their household characteristics. Current and projected demographic, lifestyle and consumer spending data about your merchandise area from secondary sources can provide this information.

Demographic and lifestyle data well-nigh your trade expanse tin give yous a starting indicate for an in-depth analysis of specific business and real estate evolution opportunities. This data also can assistance the broader customs understand how information technology is changing.

- Demographic Information

- Lifestyle Information

- Spending Potential Information

- Using GIS to Analyze Your Market place

Demographic Data

It is well understood that product preferences vary beyond unlike groups of consumers. These preferences relate direct to consumer demographic characteristics, such as household type, income, age, and ethnicity. For this reason, information technology is not just the amount of demand that truly matters to a local economic system. The mix of consumers besides has a major impact on a local economy, and therefore must be thoroughly examined in all merchandise surface area analyses. Unfortunately, far also much information often is included in these studies. An enormous amount of data is readily available from a multifariousness of private and public sources, leaving the reader with tables and tables of demographic information overload.

Relevant Data Categories

Interpretation of demographic data is often missing in market assay. What does the data say almost how the market is changing and how consumers spend their time and money? Specifically, what does the information propose near new business or existent manor opportunities downtown? The following provides a starting point in your understanding and estimation of demographic data in relative to retail spending.*

- Population and households data permit you to quantify the current marketplace size and extrapolate future growth. Population is defined equally all persons living in a geographic expanse. Households consist of one or more persons who live together in the same housing unit—regardless of their relationship to each other (this includes all occupied housing units Households can be categorized by size, composition, or their stage in the family life bicycle. Typically, demand is generated by the individual or the household as a grouping. So, the entire family influences a household purchase, such as a figurer or TV. Private purchases, on the other hand, are personal to the consumer. Predictable household or population growth may bespeak futurity opportunities for a retailer. An analysis of household and/or overall population growth provides the "big picture" of potential retail demand in a customs. However, further analysis is necessary to place retail preferences within a customs.

- Household income information is a expert indicator of residents' spending ability. Household income positively correlates with retail expenditures in many product categories. When evaluating a market place, retailers look at the median or average household income in a trade area and will seek a minimum number of households inside a sure income range before establishing a concern or setting prices. Another mutual exercise is to clarify the distribution of household incomes. Discount stores may avert extremely high or depression-income areas. Some specialty fashion stores target incomes higher up $100,000. A few store categories, such every bit auto parts, are more ordinarily institute in areas with lower household incomes. See the following box for more than details on household income. Remember, though, that using income as the sole measure of a market's ownership preferences can exist deceptive. You demand to consider all categories of demographic data when analyzing a market place.

Highly flush households with annual incomes above $100,000 comprise one of the fastest growing segments of the U.S. population, increasing by more than than 2 percentage each year since 2000. They are strong consumers, besides equally physically active and civic-minded. Gearing a retail mix toward this segment may require a focus in luxury goods and services. High-end section and engineering stores, every bit well as cultural amenities like museums and concert halls, are frequented past the most affluent households inside a population.Eye-income households with annual incomes between $twenty,000 and $l,000, are much more mindful of their expenses than highly affluent families. These households tend to be more frugal and selective in their buying behavior, shopping at discount outlets for groceries and other goods rather than high-end stores. Big box stores are peculiarly popular for middle and low-income households.Depression-income households with annual incomes below $20,000 are in a unlike situation than affluent and middle-income households. Families at this income level are living in poverty and thus spend very little on goods and services across the board.

- Age is an important gene to consider because personal expenditures change as individuals grow older. We've already noted that purchases change throughout a family unit's life bike, and that holds true for individuals, likewise. I important phase of life, and a category that's growing as baby boomers age, is the 65 and older grouping. Realizing and catering to the needs of an crumbling population can be beneficial to any retailer. Consumer spending on drug stores and assisted care services flourish in areas with a large elderly population. Accordingly, drug stores often do well in communities with a larger number of people over the historic period of 65. In general, though, older populations tend to spend less on the majority of goods and services. Studies point that nightlife and amusement spending (restaurants, bars, and theaters) past people over 65 is roughly half that spent by those under 65. Older adults likewise spend considerably less on apparel than other age groups. On the other stop of the spectrum, toy stores, solar day care centers, and stores with baby intendance items do well in areas with many children and infants. Clothing stores and fast food establishments also thrive in areas with a high adolescent population. Some amusement and recreational venues, such every bit movie theatres and golf courses, serve a wide section of the population. Others, such as water parks or arcades, target certain age groups.

- Education levels also effigy into the socio-economic status of an surface area. Considering income increases with advancing educational attainment, many retailers focus on income level rather than education. There are some exceptions to this, though. Bookstores are often cited by developers as a business organization whose success is straight correlated with the number of college educated individuals in the trade area. Similarly, estimator and software stores are oft located in areas with high levels of education. In general, areas with high levels of educational attainment tend to prefer "the finer things." That is, they may have a preference for shopping at smaller, non-chain specialty retail stores located in their downtowns. They likewise tend to visit cultural establishments like museums and theaters at a frequency over three times greater than those without a college degree. On the other mitt, less-educated populations generally have lower incomes and thus tend to adopt shopping at discount retail outlets and chain stores. This group as well spends more coin on machine maintenance and tobacco products than those with a college degree.

- Occupational concentrations of white and blue-collar workers are used every bit some other gauge of a market'southward taste preferences. Specialty wearing apparel stores thrive in middle to upper income areas and those with in a higher place-average white-collar employment levels. Second-hand clothing stores and used car dealerships are successful in areas with a college concentration of blue-collar workers. Office supply stores and large music and video stores are specially sensitive to the occupational profile. These retailers target growth areas with a majority of white-collar workers.

- Ethnicity is some other factor retailers consider when choosing merchandise to bear. Data show that ethnicity affects spending habits equally much as other demographic characteristics, such as income and age. Tastes in appurtenances and services vary between ethnic groups, and local retailers are wise to cater to the different needs of indigenous groups in their merchandise expanse. Ethnicity influences retailers' production mix, including the lines of clothing they carry, and their advertising.Retailers that use sectionalization based on race and indigenous groups must make sure their efforts effectively measure the true preferences and behaviors of the community.

- Housing ownership and charge per unit of housing turnover is an important cistron for numerous retailers to consider. Dwelling house ownership straight correlates with expenditures for home furnishings and dwelling equipment. Piece of furniture, appliances, hardware, paint/wallpaper, flooring covering, garden centers and other domicile comeback products all prosper in active housing markets.

*Adjusted from:

White, J.R., & Gray, Yard.D. (Eds.). (1996). Shopping centers and other retail properties: Investment, development, financing and management. Hoboken, NJ: John Wiley & Sons.

Waldfogel, J. (2010). Who benefits whom in the neighborhood? Demographics and retail product geography. In Glaeser, E.L. (Ed.), Agglomeration economic science (pp.181-209). Cambridge, MA: National Bureau of Economic Research..

Comparing the Primary Trade Area with Other Areas

Demographic statistics are especially useful if they are presented in comparison with other places. To run across how your trade surface area differs from other places, it is useful to provide two comparison sets of information: comparable communities and the state or United States equally a whole.

Comparing your trade area with other communities and the state allows demographic baselines to exist established. These baselines will assistance determine whether your trade surface area has low, median, or high values in each demographic category. For instance, after examining demographics for your merchandise expanse, it may announced that at that place is a loftier proportion of white-neckband workers. However, this ascertainment cannot be verified until you know what constitutes an average number of white-collar workers.

Comparable communities can include v or six cities of similar size in the same region or country. The cities chosen should reverberate similar distances from metropolitan statistical areas (MSAs) of the region. Depending on the geographic size of your main trade area, you volition need to select similar-sized trade areas.

In addition to comparable communities, adding state or U.Due south. statistics will provide a broader benchmark for comparing your customs. State and U.Due south. data will include a alloy of urban and rural areas. Appropriately, it will non be limited to "similar places." Yet, differences between the trade area and the state or United States (such as per capita income) will be used afterwards in your analysis of retail or service business opportunities.

Demographic Data Sources

Detailed local census data is readily bachelor costless via the Net through the U.S. Bureau of Census at http://www.census.gov/. Census data tin be retrieved at several geographic levels (county, city/village, census tract, zip lawmaking, etc.). The U.S. Census website includes a link to its convenient data-filled website called American FactFinder at http://factfinder2.census.gov. Use American FactFinder to view, print, and download statistics nigh population, housing, industry, and business. Using FactFinder, you can also notice U.S. Census Bureau products; create reference and thematic maps; and search for specific data.

In improver to the Census Bureau, at that place are numerous, nationally recognized data firms that can provide demographic estimates for a detail merchandise area. While much of these firms' data is based on the U.S. Census and other public sources, they add value by providing annual updates. They also bundle the information in user-friendly comparative formats that make it easy to compare one geographic expanse with some other. Furthermore, yous are able to tap into the knowledge of skilled demographers who have designed information products centered on particular industry needs. These firms provide a manner to order reports by simply calling a price free number or downloading the data directly using their software. Prices charged past these firms have become more and more than affordable as competition has increased.

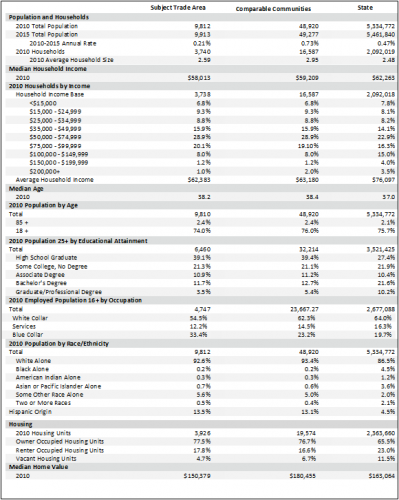

Following is an example of a demographic comparing study assembled for a sample community from a private information source. The "discipline trade surface area" column reflects demographics data on the trade area. The "Comparable communities" cavalcade reflects the demographic averages of five or six other places and the "Land" cavalcade provides a third level of comparison.

Sample Demographic Comparison Report

Lifestyle Information

Adding consumer lifestyle data takes the market analysis a step further. This data recognizes that the way people live (lifestyle) influences what they purchase as much equally where they live (geography) or their age, income, or occupation (demography). Lifestyle data enables you to include people's interests, opinions, and activities and the effect these take on ownership behavior in our analysis.

Theory backside Lifestyle Segmentation

In his 2010 paper "Who Benefits Whom in the Neighborhood: Demographics and Retail Product Geography," Joel Waldfogel examines the human relationship betwixt a community's lifestyle characteristics and its product preferences. He concludes that retail is stimulated past large concentrations of populations of similar characteristics and tastes. As a result, a community can develop product mixes targeted to specific high-potential customer segments.

Concentrations of lifestyle segments create demand for specific products or services. This trend to clusteris based on the premise that "birds of a featherflock together." Did you e'er notice that the homes and cars in any particular neighborhood are normally similar in size and value? If y'all could wait within the homes, yous'd discover many of the same products. Neighbors also tend to participate in similar leisure, social, and cultural activities.

The quality of a segmentation organisation is directly related to the data that goes into them. High quality and useful systems allow you to predict consumer beliefs. In a retail business targeting tourists, for example, the systems allow the business to identify products and services that entreatment to this market segment. The usefulness of a segmentation system depends on how well the data incorporates lifestyle choices, media use, and buy behavior into the basic demographic mix. This supplemental information comes from various sources, such equally motorcar registrations, magazine subscription lists, and consumer product-usage surveys.

Lifestyle Data Sources

Several private data firms offer lifestyle cluster systems. The firms use data from the U.S. Census and other sources to split neighborhoods throughout the U.s.a. into singled-out clusters. They utilize sophisticated statistical models to combine several master and secondary data sources to create their own unique cluster profiles. Most models start with data from U.S. Census block groups that contain 300-600 households. In rural areas, the data is more typically amassed by zip code.

One example of a cluster system used in modern demographic assay is ESRI'due south Tapestry Division http://www.esri.com/data/esri_data/tapestry.html. The organization divides every U.Southward. neighborhood into one of 65 unique market place segments based on socio-economic and demographic characteristics.

Sample Lifestyle Segment Summary

As an case, qualitative information provided by ESRI for its "College Towns" designation includes:

- Demographic: Nearly residents are between the ages of eighteen and 34, and live in unmarried-person or shared households. The racial contour is typically similar to the nation equally a whole, with three-fourths of college town residents being white.

- Socioeconomic: Because many students only work part-fourth dimension, the median household income ranks near the low end of ESRI's measurements. Nearly of the employed residents work in the service industry, holding on-again, off-again campus jobs.

- Consumer Beliefs:Convenience dictates food choices. With their busy lifestyles, residents in college towns ofttimes eat out at fast-food restaurants and pizza outlets during the week. Because many college students are new residents to a town, bedding, bath, and cooking products are pop purchases. Music and nightlife venues are extremely pop in higher towns.

The Tapestry Segmentation as well includes quantitative data, such as the purchase potential index that measures potential demand for specific products or services. The index compares the demand for each market place segment with demand for all U.Southward. consumers and is tabulated to correspond a value of 100 as the boilerplate need. Values above 100 indicate residents are more likely to buy that product or participate in the respective activeness. Conversely, values below 100 indicate residents are less likely to buy the given product. For example, an index of 120 ways that the spending potential in the tapestry segment is 20 percent higher than the nation equally a whole. Sample data for the "Higher Town" segment is equally follows:

| Consumer Behavior | Index to U.S. |

| Buy books | 106 |

| Shop at convenience stores | 114 |

| Go to bars/clubs | 214 |

| Attend movies | 135 |

| Owns a van or minivan | 27 |

From this data, a clear picture of the important demographic, socioeconomic, and consumer behavior of residents in college towns emerges. ESRI's Tapestry Segmentation system provides similarly useful information in all 65 unique market segments information technology identifies.

Other examples of segmentation systems include Experian'due south Mosaic® USA at http://www.experian.com/marketing-services/consumer-sectionalisation.html and Nielsen's PRIZM at http://www.claritas.com/MyBestSegments/Default.jsp.

Cautions Regarding Lifestyle Segmentation

Lifestyle segmentation generalizes the types of customers in your trade area, which is helpful in making sense of a complex market. This simplification, however, may not fully capture the particular traits of your customer base or may overlook the richness of groups in your area. Furthermore, since data are not continually updated, lifestyle segments are based on a snapshot in time. This works well if social and economic weather remain constant; still, meaning changes may make the segment less representative of reality. Therefore, although lifestyle segments can greatly aid you understand customers in your trade area, yous should take care not to place too much weight on partition systems. Instead, regard the data as a part of the mix of demographic information.

Spending Potential Data

Estimates of household spending give a sense of the size of a marketplace in dollars. For example, secondary data are available that allow you to approximate the size of the local food or restaurant market place, based on the number of households in your merchandise area. Private information are also available to provide refined estimates based on local demographics. It is important to remember that these estimates measure the amount of spending past households residing in your merchandise expanse, not necessarily spending inside your trade area that also includes non-residents. Conversely, residents of your trade area may choose to spend exterior your trade expanse.

Consumer Expenditure Survey

The two-function Consumer Expenditure (CEX) Survey is the primary data source for spending-potential estimates that covers a whole range of household spending from dining to travel expenditures. The Agency of Labor Statistics conducts the survey of American households continuously throughout the year and has been doing then since 1980. The results of the survey provide a comprehensive snapshot of household spending and are used to revise the important Consumer Toll Index (CPI), which significantly influences both national markets and policy.

The CEX survey includes a Diary Survey of daily purchases and an Interview Survey of full general purchases over time. The Diary Survey reflects record-keeping past consumer units (private and household shoppers) for ii sequent week periods. This component of the CEX collects data on pocket-sized, daily purchases that could be disregarded past the quarterly Interview Survey. The Interview Survey collects expenditure data from consumers in five interviews conducted every three months. The information from both surveys is integrated to provide a comprehensive database on all consumer expenditures.

Individual Information Providers

Although the Consumer Expenditure Survey data solitary provides valid and reliable estimates for your market, some individual data companies refine the CEX survey data for more than sophisticated estimates that may prove useful.

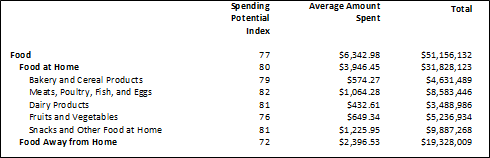

For example, ESRI uses Tapestry Segmentation lifestyle segments (see to a higher place), together with CEX data to estimate household spending. A conditional probability model links spending past the consumers surveyed to all households with like socioeconomic characteristics. The results are spending estimates based on the demographics of a particular merchandise expanse, which are reported together with the average spending per household and a spending- potential alphabetize. The alphabetize compares the spending of the trade area's households to the national average (encounter the following Sample Spending Potential Report).

Sample Spending Potential Report

Using GIS to Analyze Your Market

Demographic analysis is useful in understanding purchasing characteristics for different market segments. While demographics tin can be collected and analyzed without the utilize of geographic information systems, GIS often aids and enhances the analysis. Since most downtown professionals may not be experts in GIS, you will probably want to enlist consultants, planners and/or marketing information providers to offer technical mapping assistance. Following are two examples of using GIS to assist in demographic assay.

Using GIS to Visualize Trade Area Demographics

Demographic data for a merchandise area are often reported as single values for each demographic category. For example, the trade area income is reported as one value, fifty-fifty though income tin can vary beyond the trade area. GIS, however, tin display demographic values in finer particular by geographic unit (zip lawmaking, demography block group, etc.). Mapping these variations may reveal valuable, visual information that can be used to show the bewitchery of a downtown location and assistance in business organisation recruitment and expansion.

Effective demographic mapping requires an understanding of some basic cartographic concepts. Perhaps the most of import concept is an understanding of the problems associated with demographic densities. By nature, downtown population density is usually higher than a similar-sized expanse on a community's fringe. Moreover, many business owners would view the large concentration of customers as a competitive advantage over a not-downtown location. However, a map showing the number of people in each geographic unit (e.g. census block grouping) does not ever evidence this relationship.

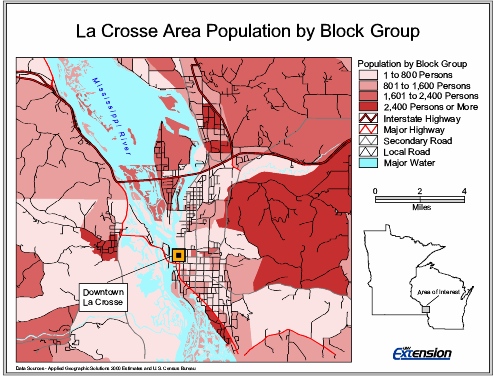

As a existent world example of this problem, consider the post-obit of the La Crosse, Wisconsin, surface area depicting the population past census block group. Why does this blazon of map fail to accurately represent the number of customers in downtown? The trouble is that the sizes of census cake groups differ. While the U.S. Census Bureau tries to command the number of households in each cake grouping, it is non always possible to make the units the same size. Problems associated with geographical barriers (rivers, mountains, etc.), the nature of population distribution (sparse or concentrated), and household size can crusade wide variations in geographic sizes and population numbers in census cake groups.

As a issue, demography block groups roofing large geographic areas tend to boss the viewer's eye on a map. When these large census cake groups are located abroad from downtown, it appears that downtown has a small population compared to the outlying urban areas. Additionally, there may be many more than block groups with smaller populations located in a smaller area. Still, their small size and small-scale population values can become obscured on a map. Consequently, the larger number and grouping of these smaller block groups need to be addressed. GIS can tackle this problem by creating a map that accurately depicts population density.

Sample Map Showing Population by Cake Group

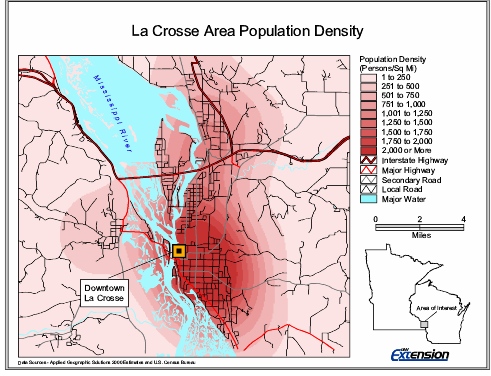

The post-obit map illustrates the same La Crosse, Wisconsin, area with an equivalent color scheme. Even so, this new map has undergone a transformation and now accurately depicts the area'southward population density. Here, the viewer sees that there is a big population amassed around the downtown and a relatively small population toward the urban fringes. The story told by the population density map would not be seen in a unmarried population value representing the entire merchandise area. As a outcome, the new map aids in showing the potential of downtown as a business organisation location and can be used as a valuable business recruitment tool.

Sample Map Showing Population Density

Using GIS to Clarify Visitor Demographics

The previous section discussed how GIS could create a useful visual representation of demographics. Notwithstanding, GIS is not limited to producing maps and graphics. GIS can as well be used as an belittling tool in demographic analysis. As an case, consider the problematic nature of assembling demographics for non-local visitors. Profiling visitors is essential in the study of tourists, commuters and other market place segments. While collecting demographics for the surrounding resident market place is a straightforward process, visitors can come from a wide expanse. Obtaining and analyzing demographics for every surface area that produced a company is unrealistic using traditional methods. In these instances, GIS can be used to profile demographics of the non-local market.

Many businesses dependent on visitors, such as hotels, maintain client address lists. These addresses are useful in market assay because knowing where visitors live provides information about their neighborhood demographics. What'south more, starting with a company's address, GIS can be used to speedily identify the census block group, or neighborhood, where a customer lives. Each demography block group is accompanied by rich demographic information bachelor through the U.S. Census Agency or through private information providers. Specifically, each census block grouping, or neighborhood, includes information on income, population, occupation, education, age and housing. This information can be entered into a GIS and used equally a surrogate for demographic information on each individual visitor.

Using this neighborhood demographic information as a surrogate is based on the premise that "birds of a plumage flock together." Equally discussed in the section on lifestyle sectionalization systems, people with similar demographics tend to live near ane another. Therefore, the demographics of a neighborhood as a whole tin can be used to correspond the demographics of an individual visitor from that neighborhood. Using addresses, GIS tin determine every neighborhood that produced a company and extract the demographics of these neighborhoods. The demographics extracted from each visitor neighborhood can be combined to produce a useful demographic contour of the visitor market place.

The demographic profile is even more than useful when information technology is given some perspective. Similar to the comparable communities analysis discussed earlier in this department, the visitor demographic contour can exist used to make up one's mind what makes visitors demographically different from the general population. Instead of comparison local community demographics to those of other communities, the visitor demographics tin exist compared to the demographics of a larger region. For case, if visitors primarily originate from a 3-land area, the company demographic profile can be compared to the demographics for the unabridged population of those 3 states. These demographic profiles of the customs visitors and the larger region can be compared on a category by category basis.

The following instance explains the steps used in GIS assay of company demographics.

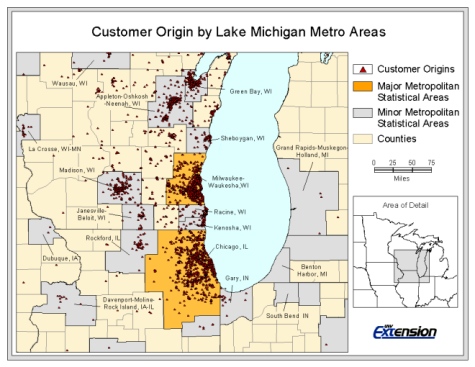

Footstep ane. GIS is used to map the locations of visitor addresses. As an case, the post-obit shows a map of visitor origins for a sample customs.

Sample Map Showing Place of Company Origin

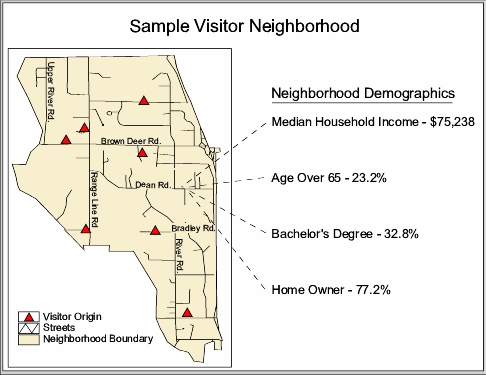

Step 2. Once the visitor origins have been mapped, GIS is used to determine the neighborhoods containing each visitor and extract the associated neighborhood demographics. These neighborhood demographics are used equally a surrogate for the demographics of an individual visitor. The post-obit is a map of i sample neighborhood showing visitor origins, as well as some of the demographics associated with the neighborhood.

Sample Map Showing Neighborhood and Demographic Attributes

Step three. GIS is used to combine all of the demographics extracted from every visitor neighborhood. Combining the neighborhoods creates a demographic profile of the visitors. To aid in the analysis, GIS also creates a demographic contour of the larger region. The regional demographic profile includes every neighborhood in the region instead of just those neighborhoods that produced visitors. These ii profiles are then used to examine differences in visitor demographics. For instance, the table shown below compares several demographic categories. The first cavalcade contains the demographic category; the second column shows the visitor demographic profile; and the third cavalcade depicts the profile created for the larger region. In this instance, GIS was able to demonstrate that visitors originated in neighborhoods that had higher incomes, a greater proportion of college-educated residents, more executive and professional employees, a higher charge per unit of dwelling house ownership, and more vehicles per household than the overall three-state region.

Sample Table Comparing Demographics of Company Neighborhoods Compared to Region

| Demographic Category | Demographic Visitor Contour | Demographic Regional Profile |

| Males | 48.7% | 48.9% |

| Females | 51.3% | 51.1% |

| Average Household Size | 2.6 | 2.v |

| Median Historic period | 36.5 | 36.5 |

| Age Less Than xviii | 25.four% | 26.7% |

| Age xvi or More | 77.three% | 76.two% |

| Historic period 25 Or More | 66.6% | 64.1% |

| Age 65 or More than | 12.6% | 12.9% |

| Median Household Income | $48,231 | $37,561 |

| Average Household Income | $sixty,973 | $40,302 |

| Per Capita Income | $21,564 | $15,694 |

| Didactics: High School | 20.0% | 21.five% |

| Education: Some College | 12.4% | xi.3% |

| Education: Acquaintance Degree | 4.iv% | 4.four% |

| Education: Available'south Caste | 13.ane% | 7.6% |

| Instruction: Graduate Degree | 7.i% | iv.1% |

| Occupation: Executive | xv.4% | eleven.2% |

| Occupation: Professional person | 17.eight% | 13.8% |

| Occupation: Technician | 3.6% | three.vi% |

| Occupation: Sales | thirteen.iii% | eleven.two% |

| Occupation: Clerical | 15.nine% | 16.one% |

| Occupation: Services | nine.6% | 12.five% |

| Occupation: Production | ix.4% | xi.1% |

| Home Possessor | 75.1% | 67.3% |

| Domicile Renter | 24.9% | 32.7% |

About the Toolbox and this Department

The 2011 update of the Downtown and Business District Marketplace Analysis toolbox is a result of a collaborative effort involving Academy of Minnesota Extension, Ohio Country Academy Extension, and Academy of Wisconsin Extension. The update was supported with funding from the Due north Key Regional Centre for Rural Development.

The toolbox is based on and supportive of the economic restructuring principles of the National Trust Principal Street Center. The Wisconsin Master Street Program (Wisconsin Department of Commerce) has been an instrumental partner in the development of this toolbox.

This section builds on work originally completed by Matt Kures, Neb Pinkovitz and Neb Ryan of University of Wisconsin Extension. This section includes new methods added by Ryan Pesch of University of Minnesota Extension and Glen Halsted, graduate student at the Academy of Wisconsin-Madison. This department was edited by Mary Vitcenda of the University of Minnesota Extension.

0 Response to "Population Demographics for Retail Industry Fashion"

Post a Comment